HSA: What is it and What are the Other Options?

- Justin Doolan

- Mar 30, 2024

- 6 min read

In my financial journey so far, I have made plenty of mistakes. Some have lasted a few years before I realized what I was doing and how much I was just wasting. Several of these mistakes I blame on not asking questions and plain old ignorance. If you are looking at this and you are in your early 20s about to enter the workforce. You are ahead of the pack. This blog is talking to my 20-year-old stupid self who just got kicked off my parent’s insurance. I am also talking to the 25-year-old who should’ve known much more and chose incorrectly during open enrollment last year.

When you enter the full-time job world you will have loads to think about. What the heck is business casual, which boss is the one to avoid, salary negotiations, the lovely dark world of Human Resources, applications that are sent into the abyss of rejection, and lovely job interviews. You also must learn about benefits. Traditional or Roth 401(k), flexible spending accounts, paid days off, and many more. If you get handed a packet on your first day, it might be a lot to decide on right away. I know I didn’t do much research when I received any of my packets, just checked some boxes, signed some paperwork, and kept my head down.

Today I want to talk about that packet, specifically about insurance. I would say I am reasonably healthy; I might get sick once a year and my allergies tend to act up at times when the pollen is floating around here in Florida. My diet and 25 pounds around the midsection might change this luck but I don’t go to the doctor all that much and some years I don’t go at all except my yearly checkup. For the company I work for now, I pay around $100 for my PPO. This is one of the easier options to choose, it’s what my parents chose, it’s what my girlfriend chose and I didn’t do any research, I just said okay! A PPO is a preferred provider organization plan. There are others around the same theme like an HMO, EPO , or there is sometimes an option for a High Deductible health insurance plan.

A PPO can be flexible at times, you can see in-network providers and out-of-network providers for extra charges. This plan will have a higher monthly premium than a high deductible plan but typically it will have a smaller deductible and a smaller out-of-pocket max. A deductible is a cost you pay full price before your insurance kicks in and begins to pay a split sometimes like 80/20 where you pay 20% up until you hit your out-of-pocket max when your insurance pays the rest. It’s nice if you are planning to have a huge medical expense coming soon. Some prescriptions are free for this plan and preventative care like the HPV vaccine and yearly physicals for free. This type of plan does NOT allow you to contribute to an HSA or a health savings account. But if you aren’t planning on a big medical expense like having a baby and if you can cover those higher deductibles without putting on debt, an HDHP paired with an HSA could be a good option. The PPO can be paired with an FSA which is a worse HSA that does not roll over. If you don’t use it, you lose it.

Some high-deductible health plans are offered by certain employers. My current employer offers one which I (stupidly) did not choose for my health insurance. These plans have lower monthly premiums and have higher deductibles and higher out-of-pocket maximums. If you are in good health this should be a good option for you. Or if you are in bad health and you will hit the out-of-pocket max quickly it could be a good option for you too but hopefully, you are in good health! The main benefit of this plan is the HSA. Just finding out about them at 25 years old has completely rocked my world.

The HSA is a tax-advantaged account that is usually tied to a high-deductible health plan. You can contribute PRE-TAX dollars just like a 401(k) but unlike that type of account, you can pull out your money at any time to cover qualified medical expenses. You can’t pay your insurance premiums with it, you can’t pay for a gym membership, you can’t pay for dispensary visits. But for any qualified health expense, you can pay pre-tax dollars towards the bill. Some do have fees so take a look at your particular plan, some have minimum account fees and fees along those lines so definitely do some more research on your specific plan. This health savings account can also be invested in the stock market, which is CRAZY! Pre-tax! Because this account is so tax-advantaged there are limits to contributions. For an individual plan, it is $4150 as of 2024 and for a family, the contribution max is $8300. In a high deductible plan the lowest possible qualifying deductible is $1600 for individuals and $3200 for families and the maximum out-of-pocket max is $8050 and family out-of-pocket is $16100. Contributing $4150 is only about $345 a month and it is PRE-TAX dollars. You can also deduct your contributions from your taxes. The tax advantages are just unreal on this account. You can pull out any of the money or the gains at any time completely tax-free to cover eligible medical expenses. It is a wonderful option but please make sure you can reach the deductible or out-of-pocket max in your emergency fund because you don’t want to go into debt. You also want to try your best to not touch the HSA and let it grow for your entire career. Just keep your receipts for all qualified medical expenses. If you only use the HSA as an extreme emergency case and just let it invest in the market and continue contributing to it. It turns into an Individual retirement account for you to pull out once you hit 65. You will have to pay taxes on it if you want to pull it out for non-medical expenses at 65 but there is a trick here.

If you keep all receipts, everything is online these days so that is great, keep all medical expenses ready to hand to the IRS at 65 or anytime. You can be reimbursed the amount of money used for qualified medical expenses. Almost like tuition reimbursement. Run that by your tax professional before you try that as they will know more about it!

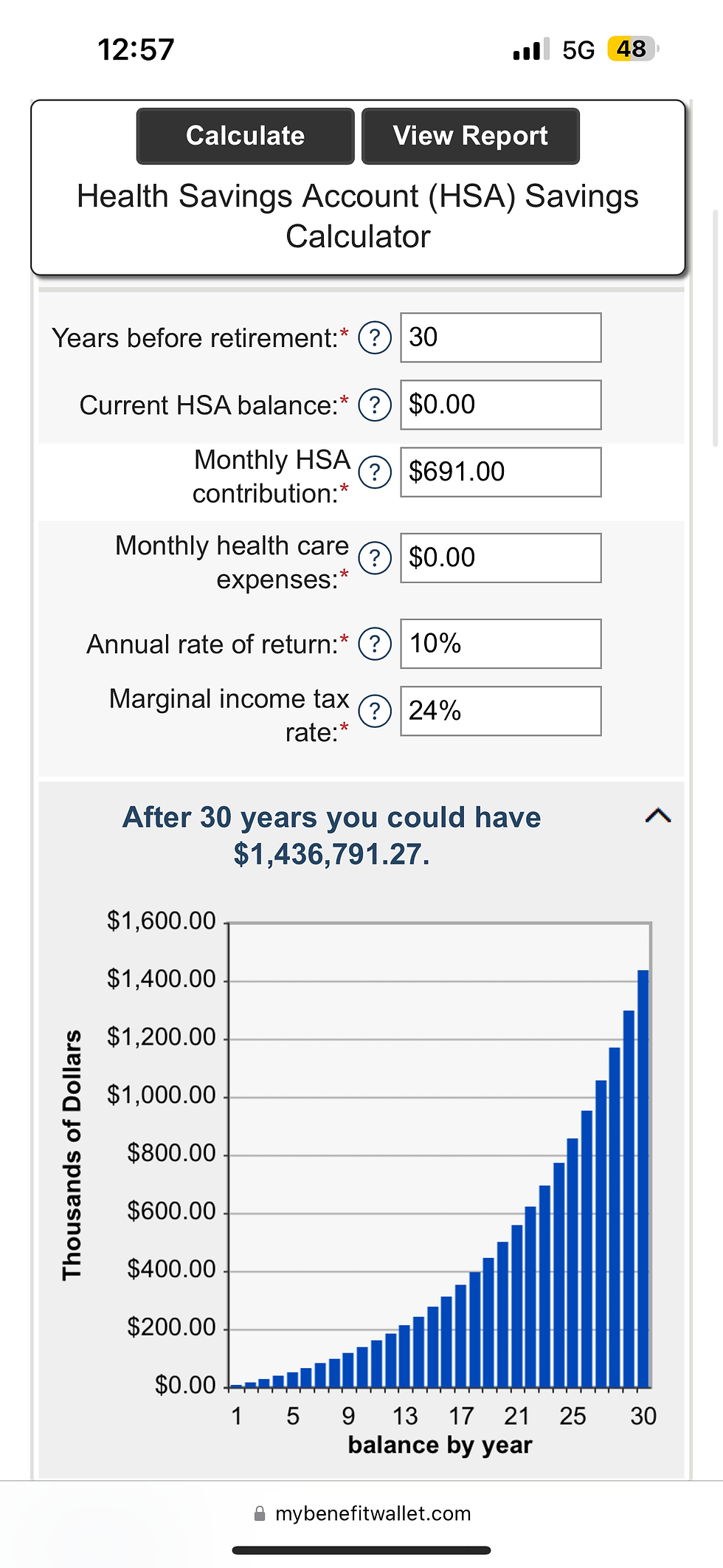

Now let’s do some calculations because if you don’t touch any of this money the growth on it is insane. It will be amazing for a health fund when we get old and have some increasingly expensive medical bills. Mybenefitwallet.com for the HSA calculator.

If you were to be a very smart individual and if your parents kick you off their insurance plan you can stay on it until 26. At 22 years old you read this and before you accept your first real-world job you make sure they offer an HSA. If you would max it out the current amount of $4150 and never touch it, just continue to make the nest egg bigger and bigger maxing annual contributions, never touching it. When you can take it out at 65 as an IRA averaging gains of conservative 7.5% not counting catchup contributions of $1000 more after turning 55. At age 65 you will have more than $1.2 million.

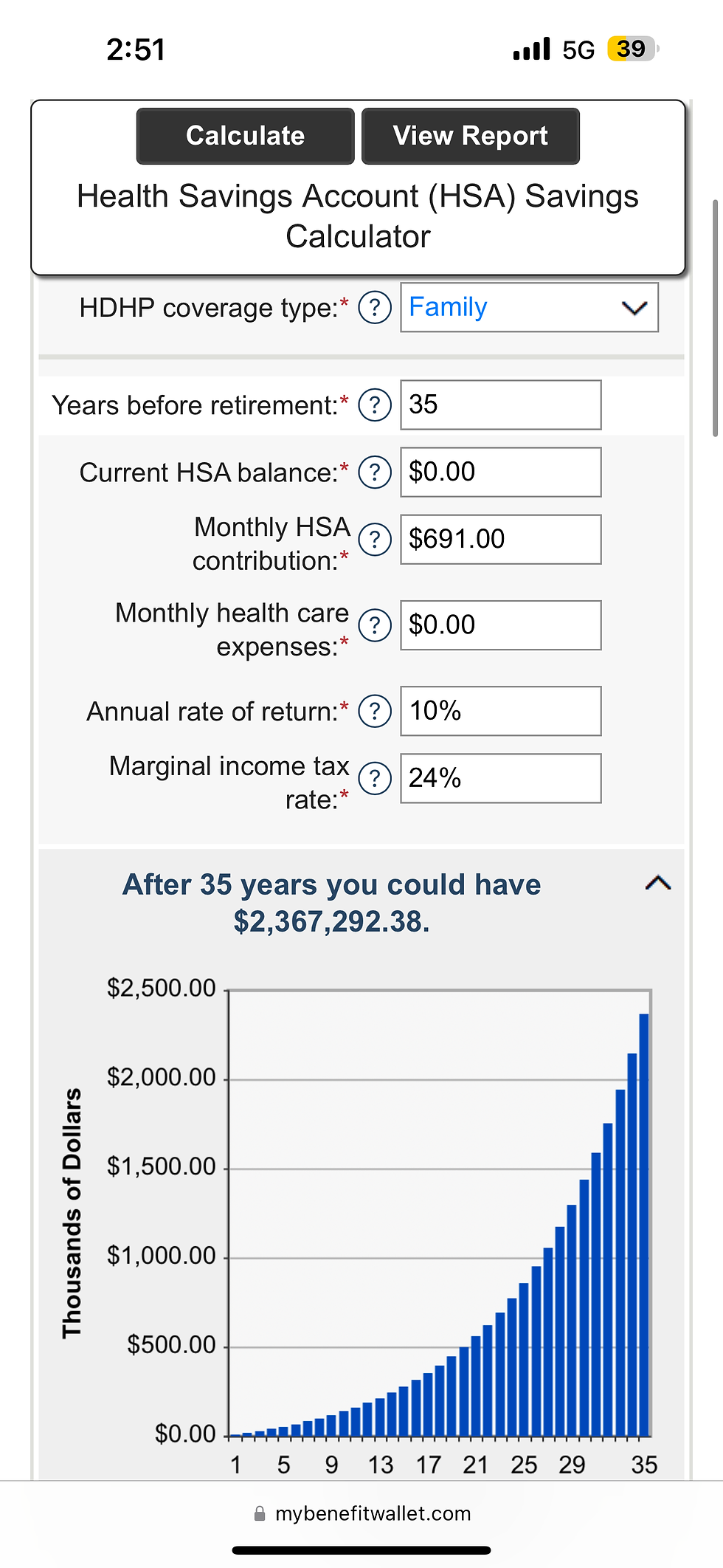

At 10% you will almost hit $2.6 million. Leave it in there and don’t touch it.

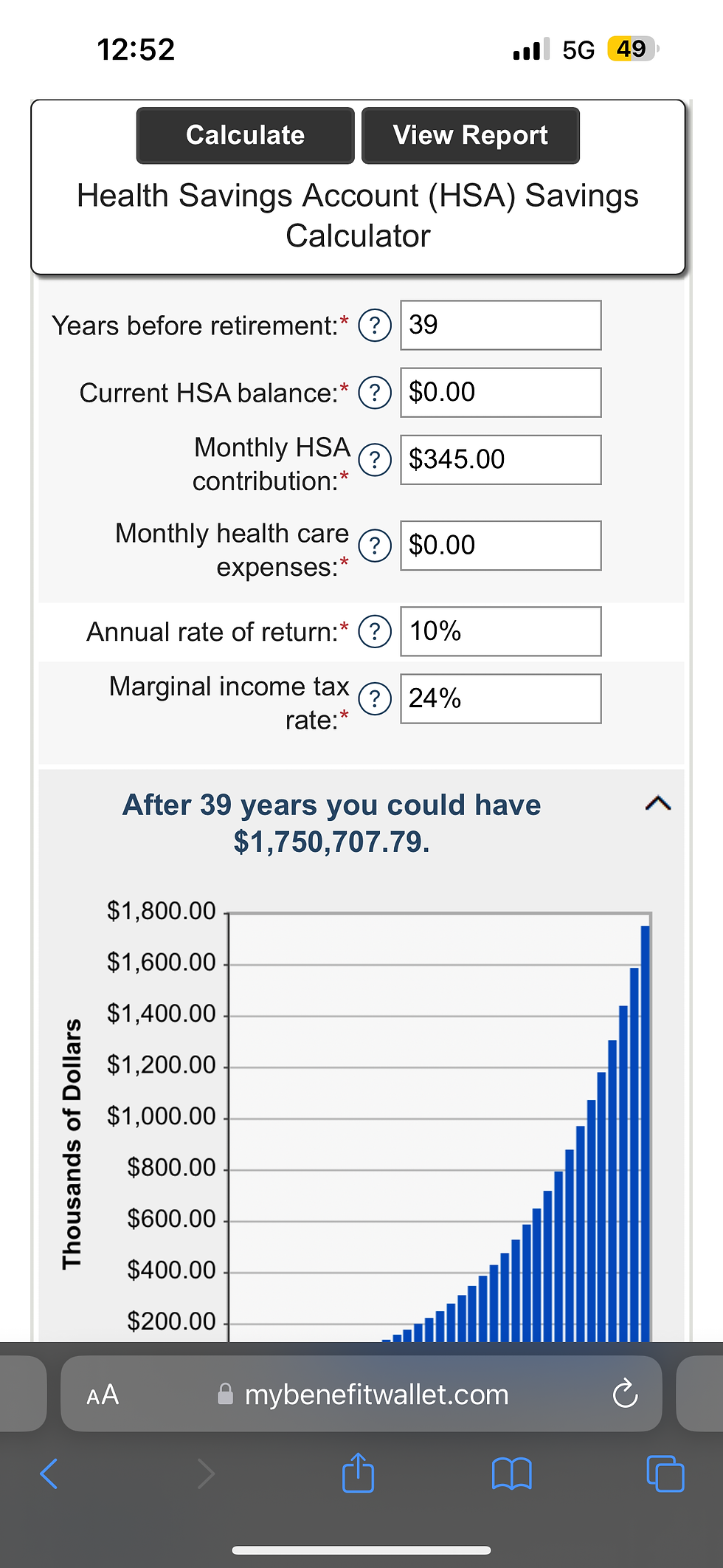

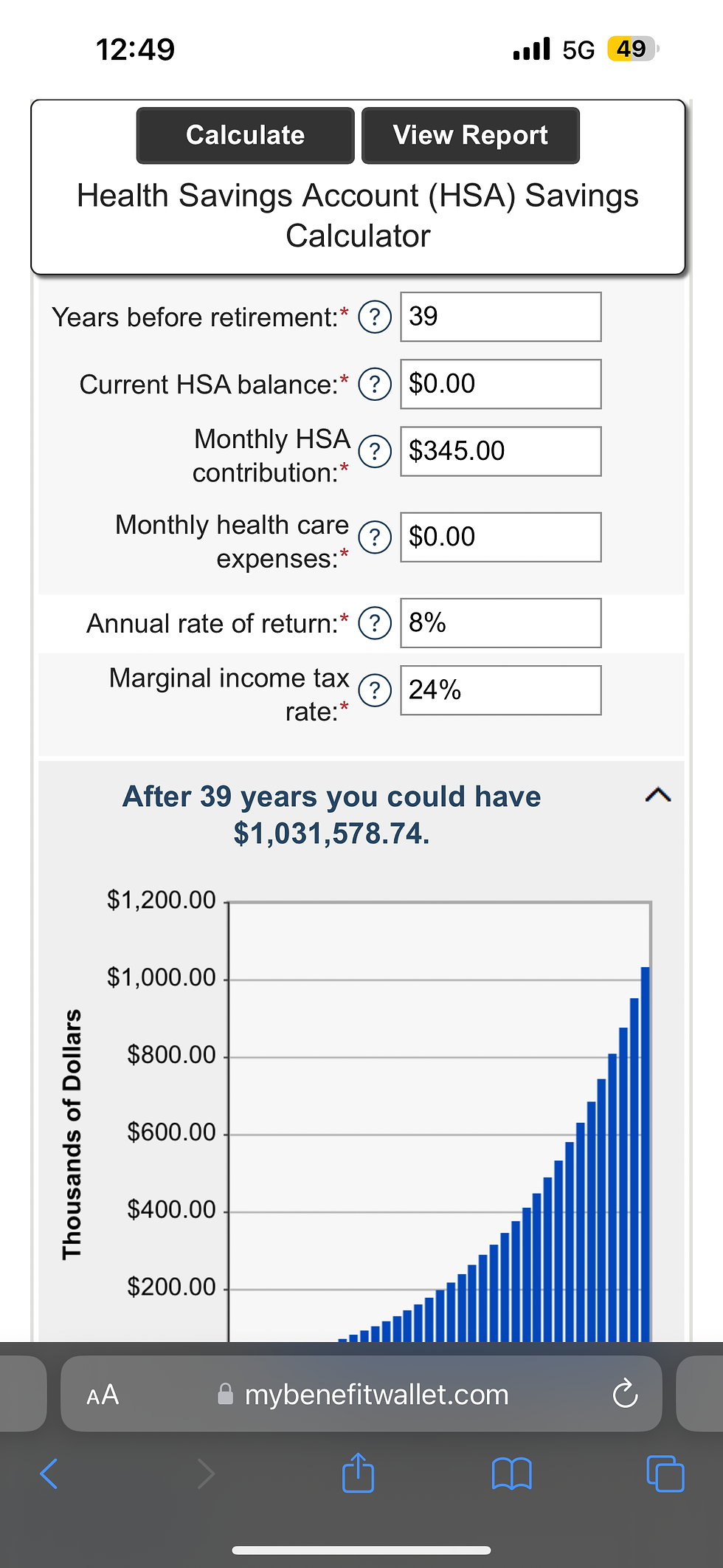

If you are like me and did not research or you are just getting off your parents’ insurance plan you will be 26. So in 39 years with the conservative 7.5% gains, you will have $908,538 in your nest egg. At 10% it is 1.75 MILLION dollars. That is a hell of a retirement account funded by Uncle Sam. After he takes his cut, you will be sitting pretty, just be sure to take your company match on HSA and 401(k) and max out your Roth.

You can also have a family HSA and like I said the limits are 8300 contributions as of 2024. If you let that sit when you are 26…. This is crazy. You will have $3.5 million waiting for you at 65 based on a 10% rate of return.

7.5% you will have $1.8 million.

The biggest takeaway today other than starting an HSA is to not touch it once it is started. Let compound growth work in your favor. Don’t just click on the PPO because your parents said it’s easier, I'm paying 100 a month into the void never having the chance to return. Don’t count on social security start investing in an HSA if you are young. Your 65-year-old self with more medical expenses will thank you for having the money saved for the knee surgery to get back to playing golf or doing the stuff they love.

TAX FREE!

Comments